How Automation Is Transforming Risk Management Across Insurance and Supply Chains

The Growing Role of Automation in Risk Management

Risk management has always been a critical aspect of insurance and supply chain operations. Businesses face increasing challenges, from regulatory compliance and vendor risks to unpredictable supply chain disruptions. Traditional manual risk management processes are no longer sufficient—they are slow, error-prone, and reactive.

To stay competitive and secure, organizations are embracing automation. AI-driven risk assessments, real-time compliance tracking, and predictive analytics are transforming how businesses manage risk, reducing exposure, improving decision-making, and enhancing operational efficiency.

In this blog, we will explore:

✅ The key challenges in insurance and supply chain risk management

✅ How automation mitigates risks and streamlines processes

✅ Real-world examples of companies leveraging AI-driven automation

✅ Best practices for adopting risk management automation

The Challenges of Manual Risk Management

Both insurance providers and supply chain managers struggle with risk exposure due to outdated risk management processes. Here’s why:

Slow and Inefficient Risk Assessment

Manual risk assessments require extensive data collection, review, and analysis, slowing down decision-making and response times.

Human Errors Lead to Compliance Violations

Failure to track compliance across vendors, contractors, and suppliers can result in fines, legal issues, and operational shutdowns.

Lack of Real-Time Risk Monitoring

Without automation, businesses react to risks instead of preventing them, exposing them to financial losses and supply chain disruptions.

Limited Data Visibility and Forecasting

Traditional risk management lacks predictive insights, making it difficult to anticipate disruptions or prevent insurance coverage gaps.

How Automation Improves Risk Management in Insurance and Supply Chains

AI-Driven Risk Assessments

AI algorithms analyze historical data, industry benchmarks, and real-time variables to assess risk levels for insurance underwriting and vendor compliance.

🚀 Example: An insurance firm uses AI to process thousands of policies in minutes, flagging high-risk clients for additional review.

Real-Time Compliance & Regulatory Monitoring

Automated platforms track compliance in real-time, sending alerts when certifications, policies, or contracts are about to expire.

🚀 Example: A supply chain company automatically flags vendors with expired insurance, preventing non-compliant partners from entering the system.

Predictive Analytics for Proactive Risk Management

By analyzing trends, automation helps companies forecast supply chain disruptions, price fluctuations, and fraud risks before they occur.

🚀 Example: A global retail chain uses predictive analytics to reroute shipments in response to potential weather-related disruptions.

Automated Vendor & Subcontractor Risk Scoring

AI tools score vendors based on performance history, compliance, and financial stability, ensuring that only low-riskpartners are approved.

🚀 Example: A construction firm reduced subcontractor compliance failures by 70% using automated vendor risk assessment.

Faster Claims Processing in Insurance

Automation reduces the time needed to process claims, verify documents, and assess damages, improving customer satisfaction.

🚀 Example: An auto insurance company implemented AI-driven claims processing, reducing settlement times from weeks to days.

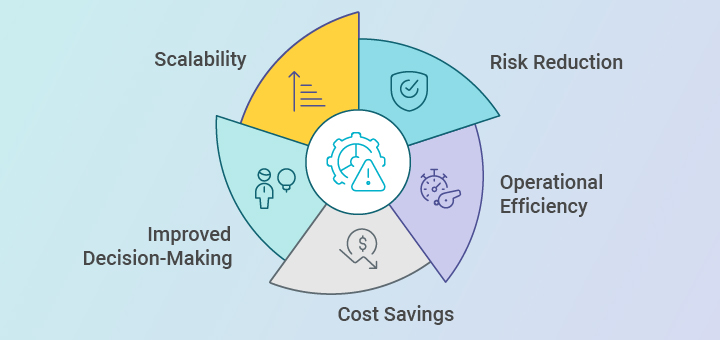

Key Benefits of Automation in Risk Management

1. Risk Reduction

Identify compliance violations, fraudulent activities, and supply chain disruptions before they escalate.

2. Operational Efficiency

Save time and resources by eliminating manual risk tracking and compliance checks.

3. Cost Savings

Reduce penalties, legal fees, and revenue losses from supply chain breakdowns and insurance disputes.

4. Improved Decision-Making

Gain real-time, data-driven insights for better strategic planning.

5. Scalability

Automation grows with your business, handling larger datasets and multiple risk variables effortlessly.

Industry Trends in Risk Management Automation

Blockchain for Transparent Risk Tracking

Companies are leveraging blockchain to create tamper-proof compliance records, reducing fraud and increasing accountability.

IoT for Real-Time Risk Monitoring

Internet of Things (IoT) sensors are tracking real-time supply chain conditions, preventing asset damage and shipment losses.

AI-Powered Fraud Detection

AI tools detect insurance fraud patterns, minimizing losses from false claims and policy misrepresentation.

Cloud-Based Risk Management Platforms

Cloud-based solutions offer centralized, remote access to compliance data, reducing dependency on local servers and manual logs.

Real-World Case Study: How a Logistics Company Reduced Risk by 60% with Automation

A global logistics provider struggled with:

❌ Vendor compliance gaps.

❌ Frequent shipment delays due to mismanaged risks.

❌ High insurance premiums due to unverified risks.

Solution:

✅ They implemented an AI-powered risk management platform, integrating real-time vendor compliance trackingand automated risk scoring.

Results:

Reduction in vendor-related compliance issues

Faster claims processing for damaged goods

Decrease in supply chain

insurance costs

How to Implement Risk Management Automation in Your Business

- Identify Risk Management Gaps

Assess current compliance processes, insurance tracking, and supply chain risk factors. - Choose the Right Automation Tools

Look for AI-driven compliance software and predictive analytics platforms tailored to your industry. - Integrate with Existing Systems

Ensure seamless integration with ERP, procurement, and insurance tracking tools. - Train Teams on Automation Tools

Conduct training sessions to maximize adoption and efficiency. - Continuously Monitor and Optimize

Use real-time dashboards to assess ongoing risk levels and performance trends.

Future-Proof Your Risk Management with SmartCompliance

Manual risk management processes leave your business vulnerable. It’s time to automate and protect your organization!

Book a free demo AI-driven risk management solutions today!

Stay ahead of compliance, reduce risk, and safeguard your operations.