Artificial Intelligence: How to Harness It to Improve Insurance Compliance

What is artificial intelligence?

Have you ever asked Alexa to play your favorite song or had Siri give directions to the nearest coffee shop? Well then, consider yourself one of the millions of Artificial intelligence (AI) users!

But, what is AI? AI stands for Artificial Intelligence and in simple terms, refers to the ability of a machine or program to demonstrate behaviors associated with human intelligence, like problem-solving or analyzing documents.

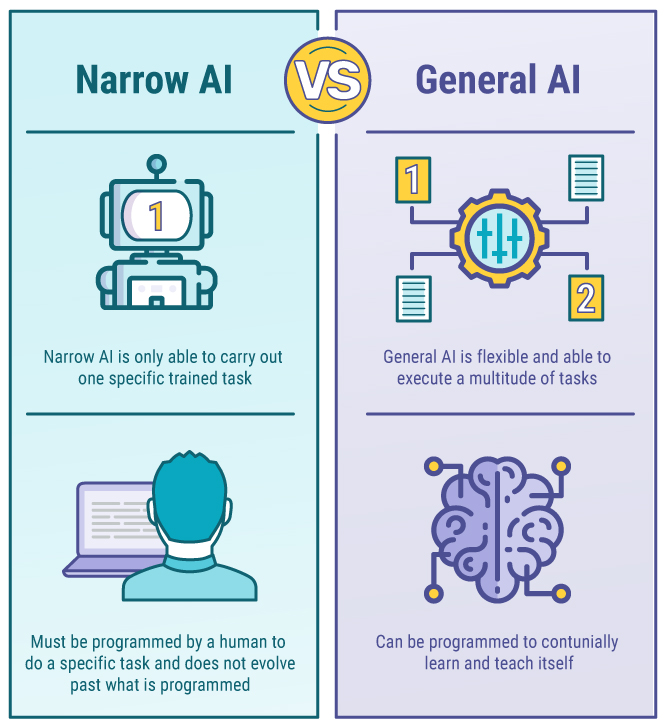

There are two categories associated with AI, narrow AI, and general AI. Narrow AI is only able to carry out one specific trained task; things like recommending products on Amazon, or even self-driving cars. General AI is flexible and able to execute a multitude of tasks and can be programmed to learn and teach itself, something we refer to as machine learning.

Now that you understand the basics, let’s dive into what we can expect from artificial intelligence and insurance in the coming years and explore the various ways we can harness AI to improve compliance for risk managers, insurance consultants, and brokers.

Text Version

Narrow AI VS. General AI. Narrow AI is only able to carry out one specific trained task and must be programmed by a human to do a specific task and does not evolve past what is programmed. General AI is flexible and able to execute a multitude of tasks, it can be programmed to continually learn and teach itself.

The Future of Artificial Intelligence

AI is becoming more and more widespread. It’s used in voice assistants like Siri and Amazon’s Alexa and there are even technologies allowing detection of lung cancer and heart disease. This wide range of possibilities means new and innovative AI software is emerging and will affect many aspects of our lives.

AI researchers have begun to train programs to do our jobs for us, focusing on the more systematic and mundane tasks such as automated certificate of insurance tracking using optical character recognition. This doesn’t mean we’re all going to lose our jobs to Artificially Intelligent machines in the insurance industry. AI gives us the possibility to use machines to perform time-consuming and strenuous tasks, allowing for more efficiency in the workplace, and giving humans a chance to focus their hard work in areas AI can’t.

Optical Character Recognition & AI

Recently, LawGeex conducted a study on using AI to review legal contracts. They found lawyers had an average accuracy rate of 85%, compared to the AI’s near-perfect score of 94%. Even more impressive is the speed; lawyers took an average of 92 minutes to finish, versus the 26 seconds (yes, seconds!) it took the AI!

AI proved to be more accurate and efficient than human lawyers when approving everyday contracts because of their use of Optical Character Recognition (OCR). Although the accuracy could be comparable at times, the speed varies in an impossible way for humans to reach.

A recent article by Exari explains AI is “automating certain repetitive tasks and enhancing human capabilities.” This is being done by utilizing OCR to streamline basic monotonous tasks.

The Optical Character Recognition in these machines scan documents and converts them into machine-readable formats to eliminate human tasks like checking dates and policy numbers.

So how do these studies apply to risk managers, insurance consultants, and brokers? Insurance document review also includes contracts and certificates, cutting manual monitoring, and improving accuracy and speed. Contract management and compliance are a big part of the capabilities of AI technology in the insurance industry and a huge step forward in streamlining these processes.

Dealing with COI’s can be a hassle. Bringing in technology that allows for automatic certification tracking and renewal management allows employees to be freed up for other job functions while also tracking compliance. This allows for more concentrated and streamlined work while handling certificates with accuracy and efficiency, too!

Don’t fall behind the competition. Integrate innovative risk management software with AI capabilities into your compliance process to streamline your COI tracking and compliance management.

Still curious about AI? Give this a read.