Certificate Holder vs. Additional Insured: The 2024 Guide to Understanding the Differences

Why Understanding the Difference Matters in 2024

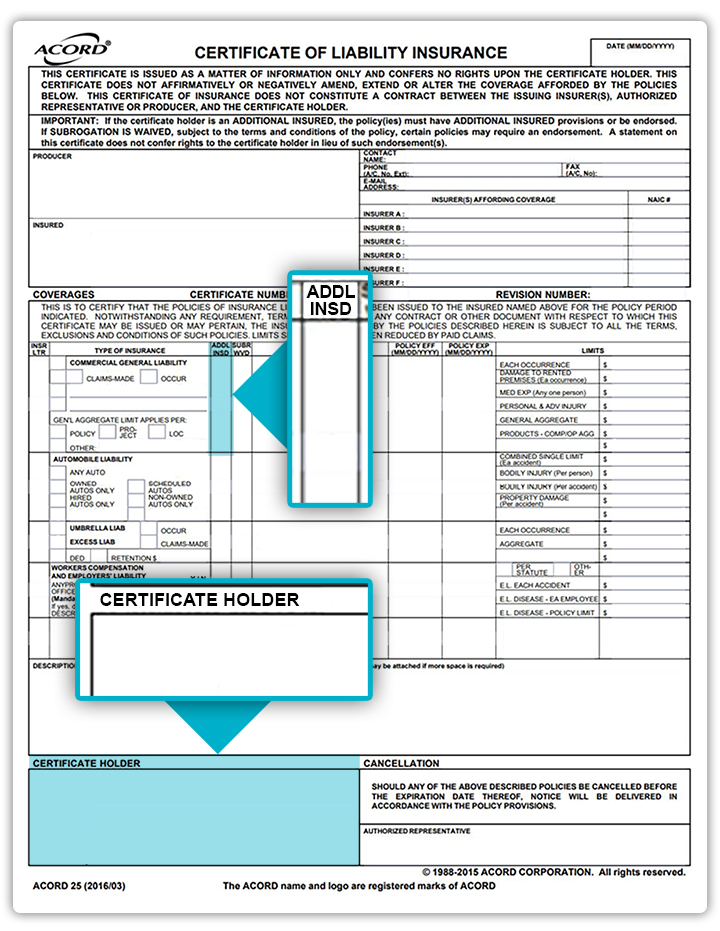

When it comes to insurance policies in industries like construction, real estate, and contracting, the roles of a certificate holder and an additional insured are often misunderstood. This confusion can leave businesses vulnerable to liability and financial risks. As insurance requirements and compliance standards continue to evolve, understanding the distinctions between these roles is critical to safeguarding your business. In this 2024 guide, we’ll break down the differences, explore why they matter, and offer actionable steps to ensure you have the right coverage.

What is a Certificate Holder?

A certificate holder is an entity or individual that receives proof of insurance from another party. The certificate, often called a Certificate of Insurance (COI), verifies that the insured party has active coverage. However, it’s important to note that a certificate holder does not receive any coverage or protection under the policy itself. They simply have documented proof that the insured party is covered by insurance.

In construction, general contractors may request COIs from subcontractors to verify they carry necessary insurance. If the general contractor is only listed as a certificate holder, they are not protected by the subcontractor’s policy if something goes wrong.

Being a certificate holder provides visibility into another party’s insurance but does not extend any liability coverage.

What is an Additional Insured?

An additional insured, on the other hand, is a person or organization added to the insurance policy of another party. This addition means that if a claim arises, the additional insured can file claims under the policy, enjoying the same protections as the primary insured party. Being listed as an additional insured is especially beneficial in risk-heavy industries like construction and real estate, where liability concerns are prevalent.

If a property owner is listed as an additional insured on a contractor’s general liability policy, and a third party is injured on the site due to the contractor’s actions, the property owner can file a claim under the contractor’s policy. This minimizes their exposure to financial and legal risks.

As an additional insured, your business can receive direct protection under another party’s policy, significantly reducing your liability.

Key Differences Between Certificate Holder and Additional Insured

| CERTIFICATE HOLDER | ADDITIONAL INSURED |

Purpose: Verifies insurance coverage exists | Purpose: Provides direct coverage under the policy |

Right to File Claims: No | Right to File Claims: Yes |

Risk Protection: None | Risk Protection: Yes |

Common Use Cases: Documentation and compliance | Common Use Cases: Liability and risk protection |

Always ensure that the Certificate of Insurance clearly indicates whether your business is only a certificate holder or listed as an additional insured.

Why the Distinction Matters in 2024

Understanding the difference between a certificate holder and an additional insured is more important than ever. Compliance standards continue to change, and companies are facing heightened scrutiny to demonstrate risk management practices. Here are some recent developments:

- Legal Requirements: Certain industries now mandate that contractors or vendors add clients as additional insureds to mitigate liability.

- Financial Protection: Without the right protection, businesses may find themselves financially liable for accidents or claims that could have been covered by another party’s policy.

- Reputation and Trust: Properly understanding and using insurance designations demonstrates a commitment to risk management, which can improve trust with clients, partners, and stakeholders.

Did You Know? In 2023, there was a 15% increase in lawsuits related to liability claims in the construction industry due to inadequate insurance coverage.

Ensuring Your Business is Properly Protected

Follow these steps to ensure you’re always adequately covered:

- Request COIs: For every contractor or vendor you work with, request a COI before any work begins. Review the coverage limits and policy terms.

- Verify Additional Insured Status: Make it standard practice to request additional insured status when relevant. This status should be reflected directly on the COI.

- Use COI Tracking Tools: Managing multiple COIs manually can lead to mistakes and missed renewals. Investing in tracking software can help you stay on top of coverage details.

SmartCompliance’s COI tracking software simplifies the management of certificates, automatically updating you on policy changes and renewals.

The Role of COI Tracking Software

Manually tracking COIs is not only time-consuming but also prone to human error. COI tracking software automates this process, allowing businesses to:

- Monitor COI expiration dates and renewal requirements.

- Ensure real-time compliance and avoid lapses in coverage.

- Store all COI documents securely and access them whenever needed

Explore how COI tracking software can simplify compliance and protect your business by requesting a demo of SmartCompliance’s platform today.

Next Steps

The difference between a certificate holder and an additional insured is crucial for businesses managing risk in today’s complex environment. By understanding these terms and ensuring the right protections are in place, you can minimize liability and maintain compliance. Take action today to safeguard your business with COI tracking and management tools.

Ready to protect your business? Schedule a Demo of SmartCompliance’s COI tracking software today and discover how easy managing your compliance can be.